|

Summary

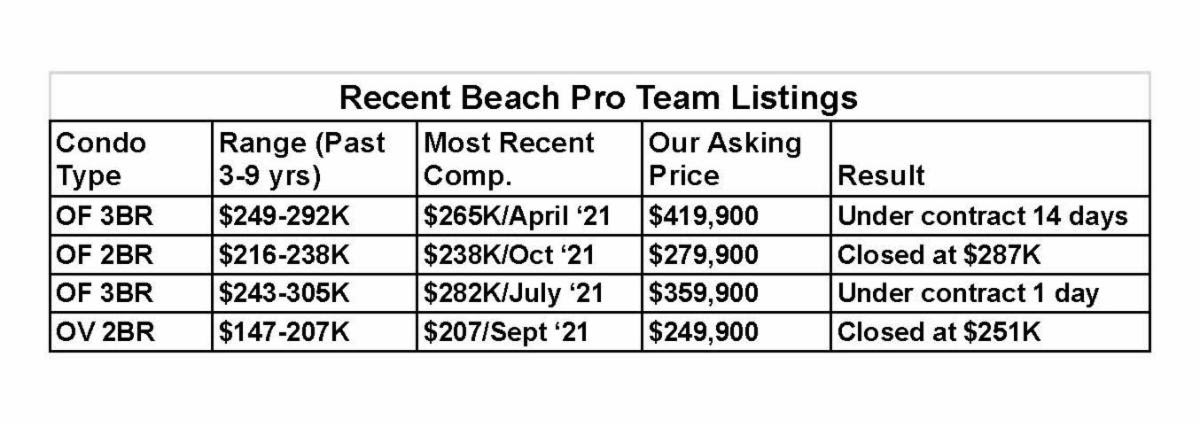

Today I’ll be analyzing some of the incredible statistics from 2021. There’s also lots of info about where the current rapidly appreciating market could be going and what’s the best plan of action to take advantage of it. This newsletter is lengthy and contains extensive market data - but I think this info could be worth a great deal of money, especially to current owners, so please read it carefully. Take a look at the table at the beginning for examples of big profits some of my listing clients have enjoyed in the current seller’s market.

We have completed our Closed Sales Histories for 2021 (to go along with our previously published yearly reports back to 2009). These are concise, organized spreadsheets providing detailed information about all of the closings (per MLS) in over 190 oceanfront and resort condo developments.

Click on the following link to gain access to our Closed Sales Histories from 2009 to 2021

www.grandstrandclosedsaleslist.com

You can also sign up for these on our website (Beachproteam.com)

PLEASE NOTE THAT MARKET VALUES FOR MANY PROPERTIES WERE INCREASING RAPIDLY AT THE VERY END OF THE YEAR AND CURRENT SELLING PRICES MAY BE CONSIDERABLY HIGHER THAN THE CLOSED SALES WOULD SEEM TO INDICATE. PLEASE CONTACT US FOR AN UP-TO-DATE EVALUATION. MUCH MORE ON THIS BELOW.

BUYERS: Oceanfront and resort condos on The Grand Strand are great deals even at the present higher prices. With the current low inventory often resulting in competing offers for the few listings it’s more important than ever to have the best buyer’s agent in your corner. None are better than our buyer’s agent, Teressa Carter. Contact us now if you are interested in buying!

OWNERS/SELLERS:

Your Condo is Worth More Than You Think (Way More!)

DO NOT accept a direct offer for your property from a buyer or buyer’s agent even if the proposed price is higher than recent closed sales! Recent closed sales will almost certainly lead you to think your property is worth less than it is (see the table of my sales prices for my listings versus recent closed sales in the newsletter). These buyers and buyer’s agents are NOT representing you or trying to give you your best price. You will almost certainly leave money on the table compared to what we could get you with a well-designed and aggressively priced listing in our very competitive open market.

The reason for these startling jumps in value is that resort condo prices only go up sharply when rare circumstances result in inventory dropping to zero - and now is one of those rare opportunities. We might be able to sell it at a MUCH higher price than recent closed sales would indicate. Please contact me to find out the market value for your property. You’ve got nothing to lose by asking!

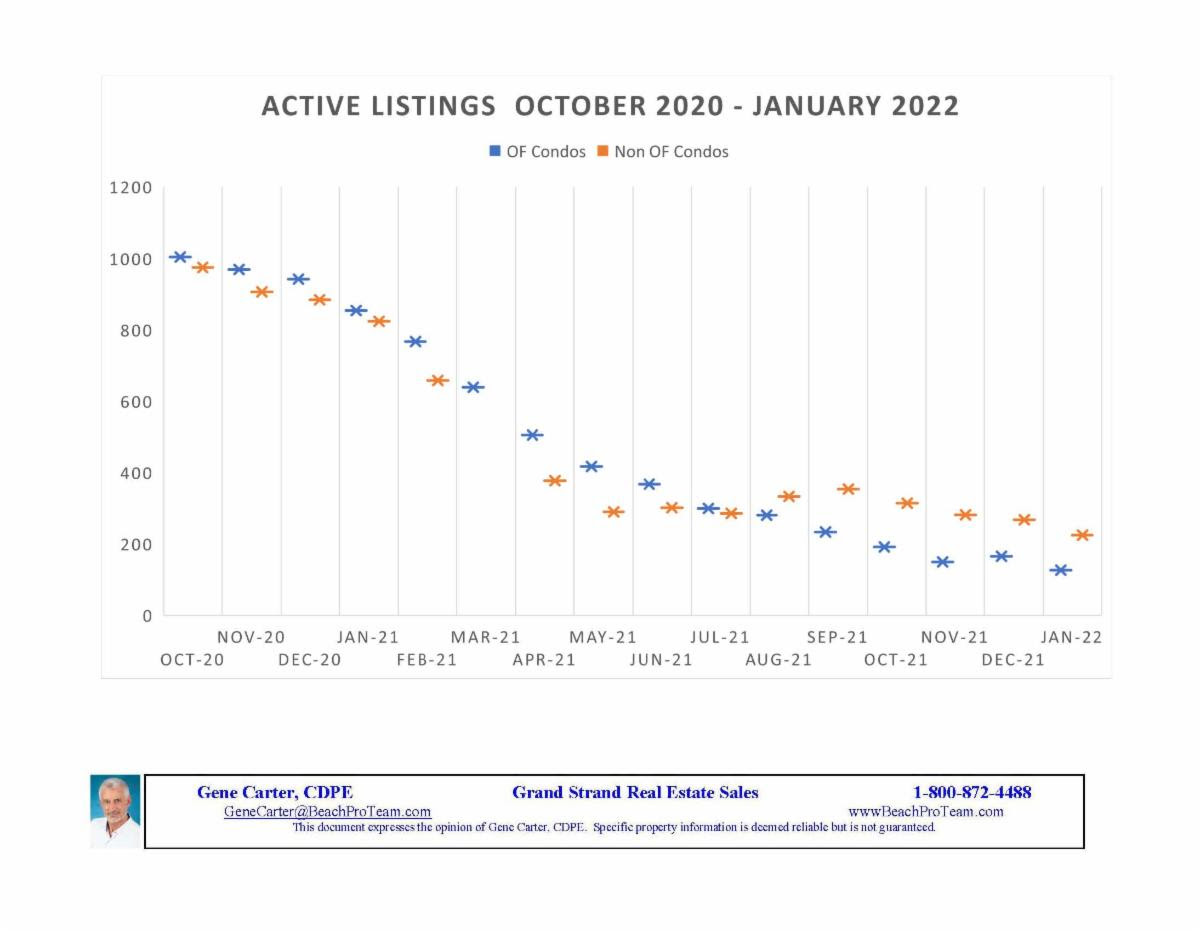

See the updated graph of active listings I’ve been including in my newsletters each month. The numbers of oceanfront listings (127) and non oceanfront listings (225) have both reached new lows.

Consider Selling Now Whether You Need To Or Not

If you have any “reason” to sell, now is the best time in 15 years (You will see this statement again).

Even if you have no “reason” to sell - think about it anyway (and contact me for a free evaluation). This has already paid off big for several of our clients. Call us for an evaluation!

In addition to the higher prices, oceanfront and resort condos have been selling faster and the contract terms have been better than they have been in many years.

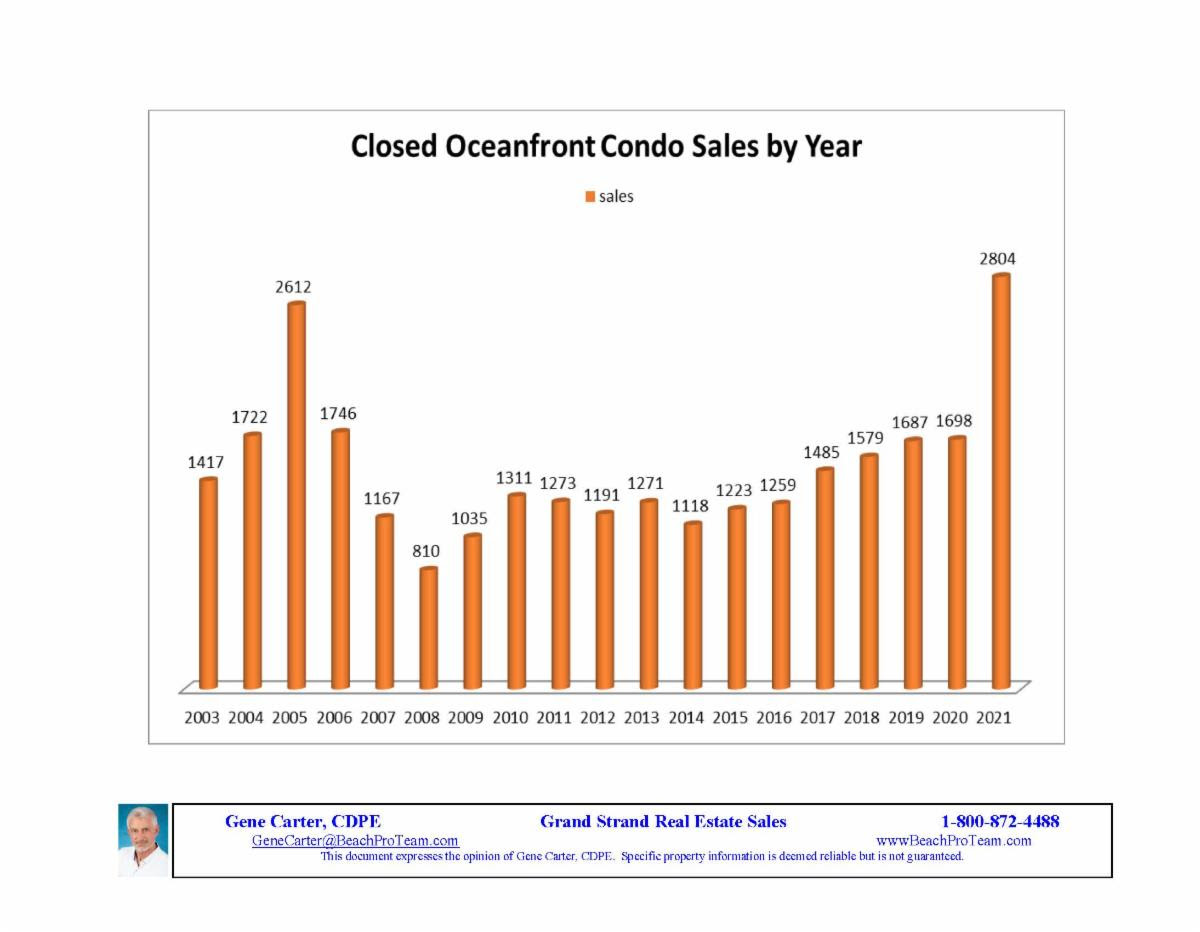

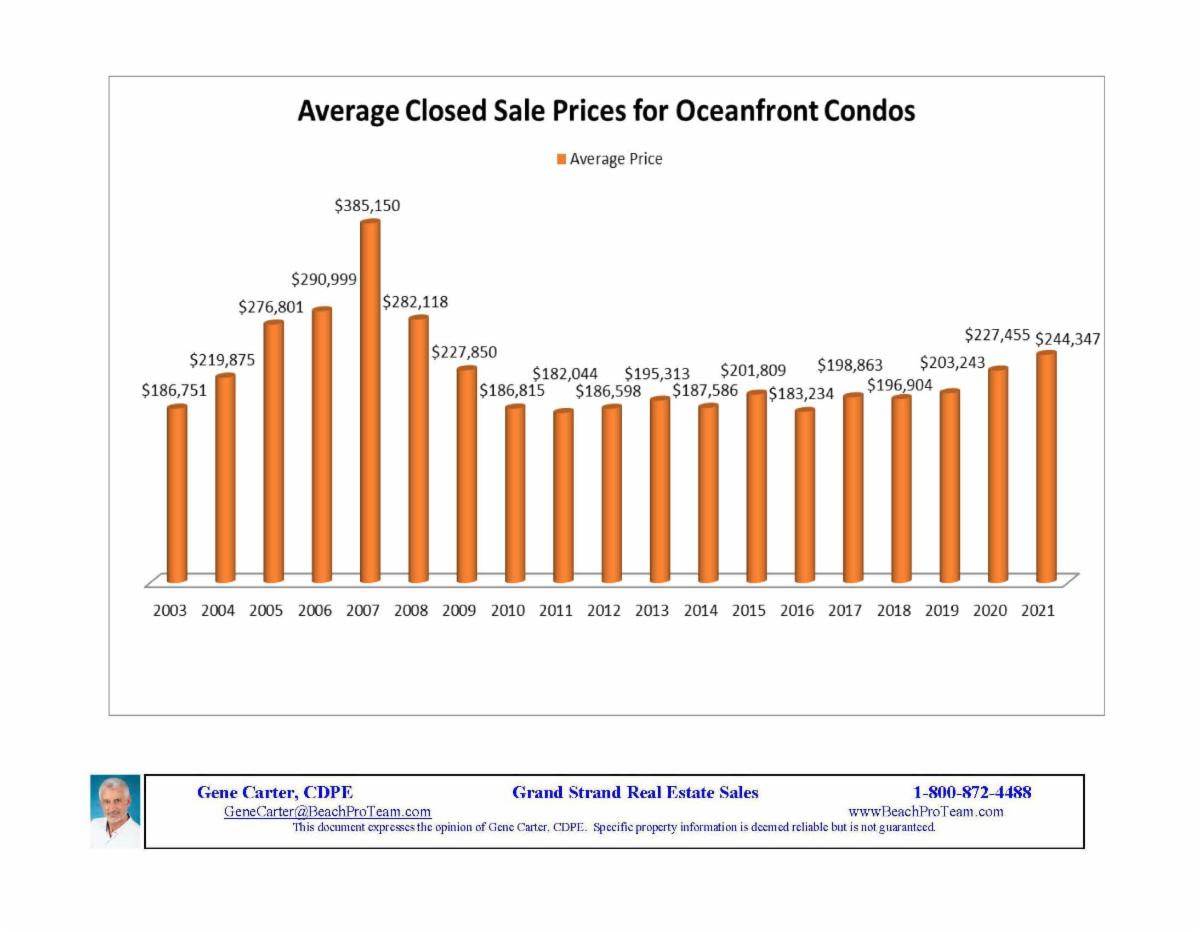

There are 3 graphs in the newsletter which illustrate just how unusual our current market is (yearly history from 2002 to 2021 for oceanfront sales, average prices and median prices). When examined together, they present a seemingly contradictory picture. The number of sales in 2021 increased by a whopping 65% over 2020 but the average price only increased by 7.4% and the median price only increased by 2.7%. With all those sales, why didn’t prices go up more?

The reason for the disconnect is that all those listings had to be sold (at the same prices at which they’ve been selling for years) to get down to that magic “zero” inventory state that makes buyers willing to pay higher prices. This didn’t happen until right at the end of the year, especially for the condotels, which make up the majority of the volume of sales.

The huge number of sales also presents a question - why did so many buyers decide to buy oceanfront condos in 2021? In particular, the pace of condotel sales seemed to accelerate at the end of the year. I think the biggest driver for increased condotel buyer interest was the fact that, as the year went on, it was becoming apparent that the rental incomes for 2021 were going to far surpass those of any previous years’ (by 20% to 35% in many cases). Condotel prices have always had a strong correlations to rental incomes - incomes up / prices up, incomes down / prices down. Hopefully 2022 will be equally strong.

Rental incomes have a much smaller effect on prices for non-condotel resort condos. The market segments which sold faster earlier (non-condotels in NMB) started appreciating in 2018 while the condotels in Myrtle Beach didn’t really start appreciating until late in 2021 (See graphs).

So what’s going to happen in the coming months?

The one statement I can make about the current market with absolute certainty is that NOW is the best time to sell in over 15 years.

Current owners are split in their opinions as to the market direction in the coming months. Some think prices will go higher and some think they will come back down soon.

The factor that is most likely to end this seller’s market (and which does not involve any doom and gloom) is simply for more owners to list their properties for sale because of the higher prices. The trajectory and eventual peak of the market will be determined by the relative pace of new listings verses buyer demand. If buyer demand keeps up with the increased listing pace, prices should at least stay high or possibly increase more. If the listings increase faster, prices will level off or possibly drop. The difference in selling your property when you are the only listing versus being just one of several nearly identical condos is huge. If you decide that selling makes sense, the safest bet might be to get your property on the market ASAP.

The truth is that no one, including me, knows when the market prices will peak and if prices will remain high or fall back. The only time we will be able to identify the peak is many months or even years after it has passed. Also, some properties have more potential upside or downside than others.

While these are exciting times for owners (and buyers), keep in mind that condos still sell whether we have a buyer’s market or a seller’s market or something in between. What’s different is that the price changes are gradual, the days on market are longer and the negotiations are tougher - in other words, normal real estate as usual. And we can help you buy or sell in that market too!

For now, please contact me to get an evaluation of your property. You will be glad you did!

That’s all for now. Check out all our usual Grand Strand Market Reports, Sales and Listing Updates, my Best Buys, and new Beach Pro Team reviews.

|